NCG SMID Cap Growth Strategy

Strategy Overview

We seek to generate long-term capital appreciation by investing in the fastest-growing and highest-quality companies in the US SMID cap growth universe

Key attributes in our investments

- Superior Revenue Growth

- Large Market Opportunity

- Leadership/Disruptive Position in the Market

- Strong Management Team

- Strong Future Cash Flow Generation

Quick Facts

Portfolio Managers: NCG Team

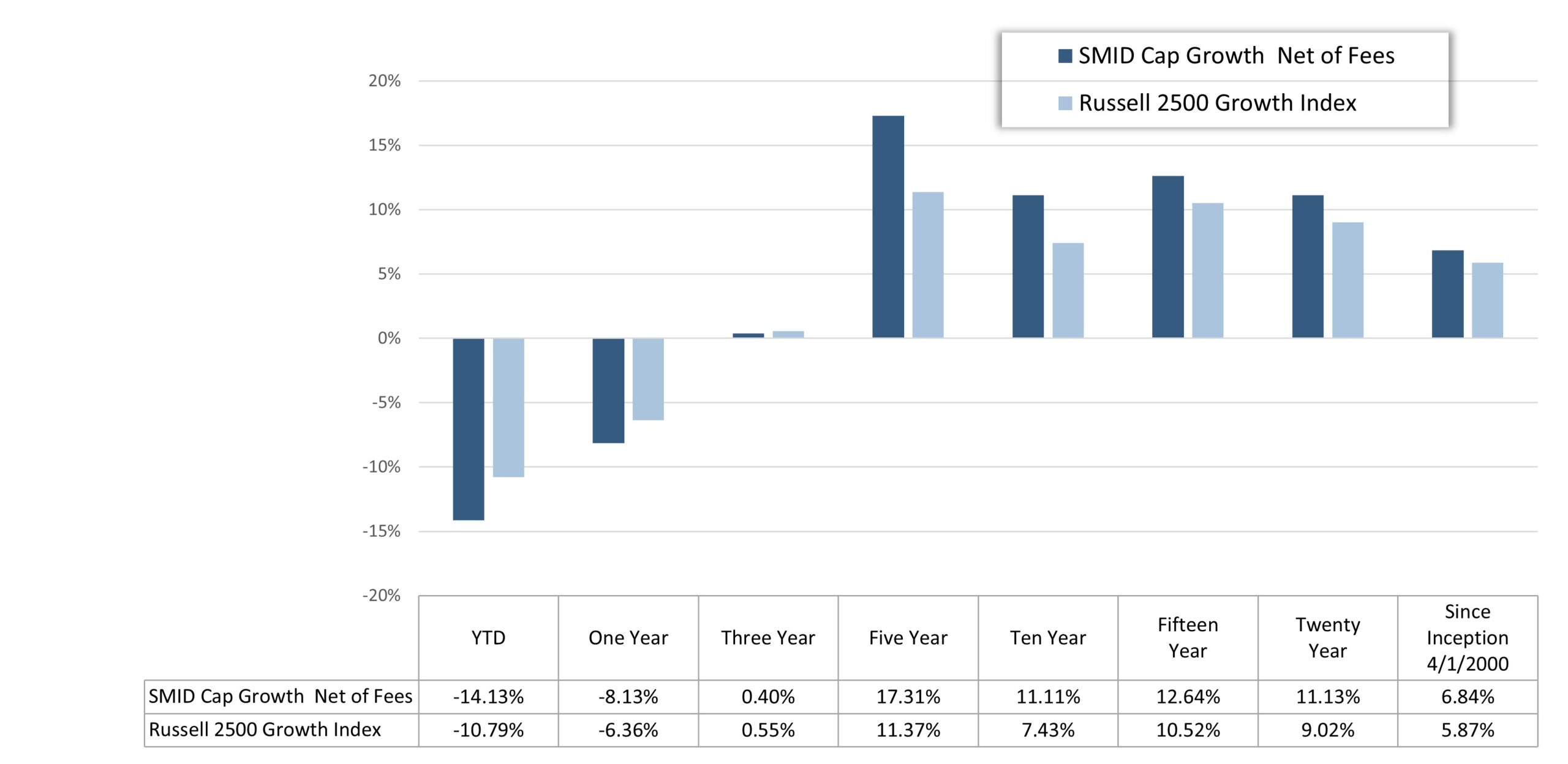

Benchmark: Russell 2500 Growth Index

Number of Securities: Approximately 40-60

Inception Date: April 1, 2000

Strategy Assets: $22M (As of 03/31/2025)