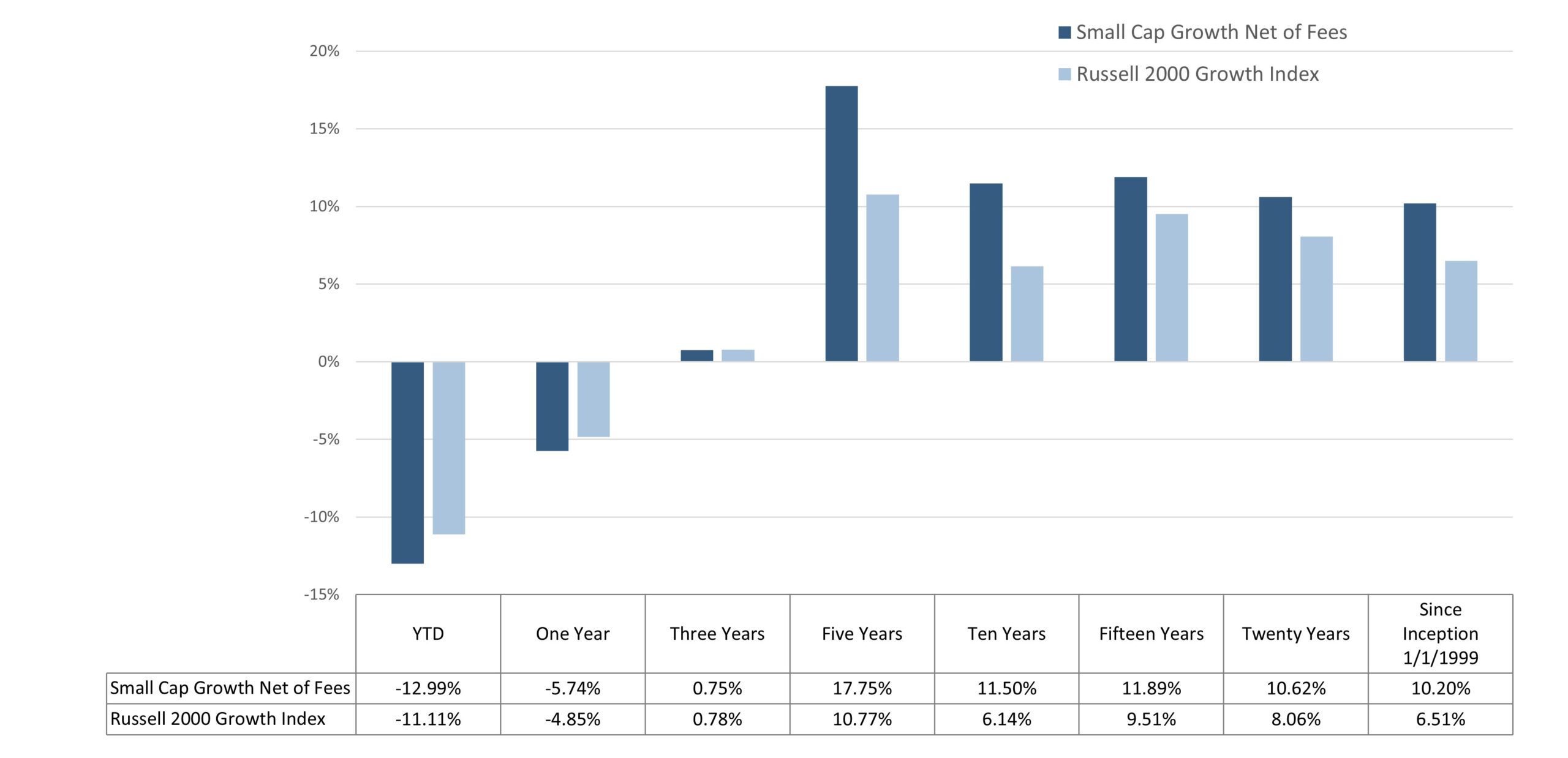

Small Cap Growth Strategy

Strategy Overview

We seek to generate long-term capital appreciation by investing in the fastest-growing and highest-quality companies in the US small cap growth universe

Key attributes in our investments

- Superior Revenue Growth

- Large Market Opportunity

- Leadership/Disruptive Position in the Market

- Strong Management Team

- Strong Future Cash Flow Generation

Quick Facts

Portfolio Managers: NCG Team

Benchmark: Russell 2000 Growth Index

Number of Securities: Approximately 40-60

Inception Date: January 1, 1999

Strategy Assets: $511M (As of 03/31/2025)